The New Normal

Published

May 22, 2021

COVID-19 has gripped the globe for months – and the effects on the Home Care and I&I industry will be felt for years to come.

“When we’re no longer able to change a situation, we’re challenged to change ourselves.”

- Viktor Frankl

In spring 2020, panic cleaning, rampant stock-ups and empty shelves dominated the headlines. The initial global spread of the COVID-19 pandemic catalyzed an unprecedented shift in consumer behavior. Months into the pandemic, purchasing decisions have continued to reflect dramatic alterations from pre COVID-19 trends.

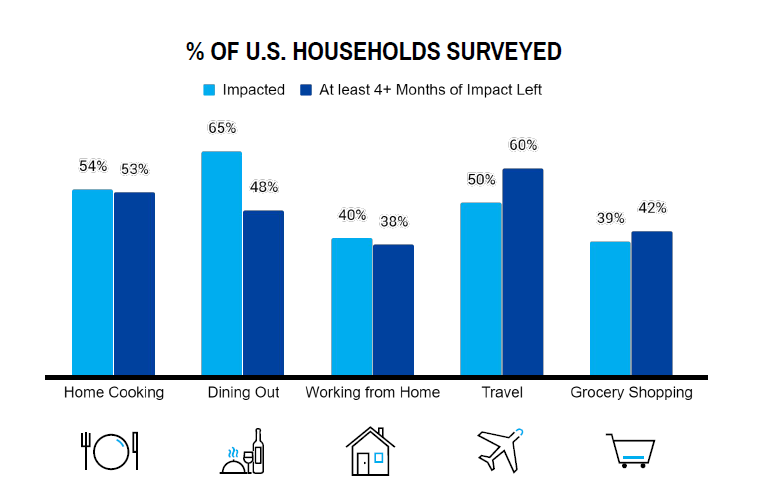

Now, the savviest brand leaders in the Home Care and I&I cleaning space are recognizing that these consumer behaviors aren’t simply a panic shift. They’re a paradigm shift. We’re entering a new normal, where consumer purchasing decisions will continue to play out in patterns that would have been incomprehensible at this time last year.Rather than wait and react to the pandemic’s unpredictable and ever-evolving course of impact, savvy brand leaders are thinking three steps ahead:

- What overarching trends will sustain even as the pandemic shifts course?

- How can we meet consumers’ needs in the long-term?

- What new dynamics (social, professional, lifestyle) will affect purchasing decisions going forward, and how can we capitalize on that?

We don’t know what will happen with COVID-19. But we do know that the Home Care and I&I market is going to look permanently different from the way it looked in 2019.

Extreme consumer hoarding was a limited trend. But what they stocked up on gives a glimpse into the future.Before COVID-19 hit North America, a few trends in the Home Care and I&I market seemed to boast inexorable traction:

- More consumers were making purchases online.

- More consumers were choosing reusable cleaning products as opposed to single-use items.

- More consumers were exhibiting “chemophobia,” prioritizing products that make claims of “green,” “natural,” “safe,” and “non-toxic.”

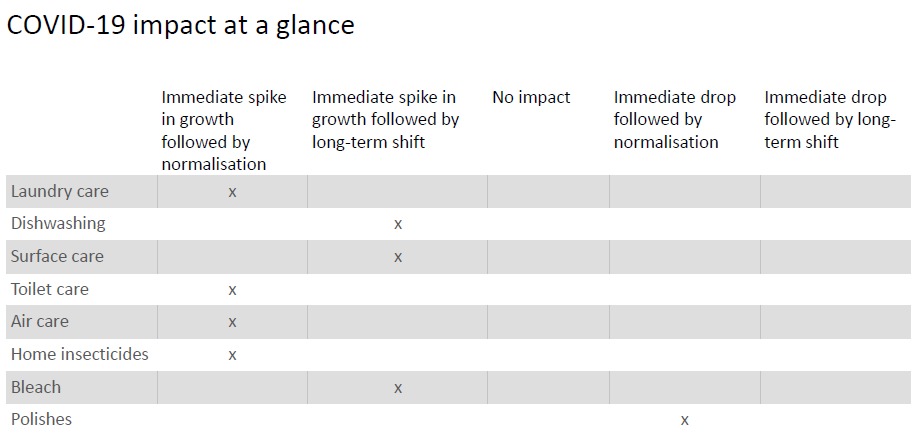

There’s nothing quite like a paralyzing global pandemic to catalyze a seismic shift. Months in, none of those trends carried forward as expected. The first (more consumers are making purchases online) experienced hockey stick-like growth as households sheltered in place and feared venturing out to make purchases.Demand fell in several categories in Q2 after stockpiling in Q1, but not categorically. Demand for certain areas, including Automatic Dishwashing (ADW) Tablets and Household Cleaners remained extraordinarily strong in Q2 even after initial stockpiles. These trends respectively reflect the disproportionate number of meals taking place at home and an ongoing prioritization of regular cleaning at home. These trends are likely to sustain through the duration of the pandemic, and (especially in the case of household cleaners), potentially beyond.

Retail data for U.S. for the first half of 2020:

- Liquid Laundry Detergent and Unit Dose Laundry Detergent: Up by 11% overall in both categories; demand in Q2 has returned to 2019 levels, presumably due to stockpiling

- Auto Dishwashing Tablets: Up by 24%, with Q2 demand going strong

- Household Cleaners: Up by 28% with Q2 demand staying steady

The second and third trends made stunning reversals. The cleaning wipes category shot up 104% from Q4 2019 to Q1 2020, and the shift is even more visible when it comes to the chemophobia trend.In this section, we explore the chemophobia reversal – plus two more key trends that are likely to shift the way consumers behave even if and when COVID-19 is brought under control.It’s critical to note that while much of this discussion centers specifically on household cleaning and not the broader Home Care and I&I space, consumer demand in the former will have a significant impact on the latter. As consumers prioritize effectivity (stronger cleaners) and convenience (e-commerce), the I&I industry must shift accordingly. Industrial and institutional cleaning companies must adjust to facilitate new consumer demands, new lifestyle patterns, and overcome increased pressure to provide assurances about level of sanitation and commitment to safety.

TREND 1: E-Commerce isn’t going anywhere

Kantar Group recently explored the effects of COVID-19 on consumer behaviors and reports that the fastest growth category is in High Convenience, e.g. e-commerce, with 22% growth. This tops Proximity and Value for Money (reporting a 3.6% uptick for Convenience and 4.4% for Discounters), Niche-Local Opportunities (up 2.6% for both Drugstore/Pharmacy and Cash & Carry), and “No More Uniques” (reporting just a 0.8% uptick for Hyper Super and 1.8% for Traditional).Nielsen has been keeping close tabs on the evolution of consumer behaviors, updating trends weekly. The extraordinary spikes seen at the onset of the pandemic in the United States (the week ending March 14, 2020) calmed down as expected, but three-quarters of the retail categories in Nielsen’s report are still showing increases over one year ago.

For the week ending July 4th – four months after the pandemic went into full swing in the United States – Nielsen noted a few highlights:

- E-Commerce is still continuing to rise, with more buyers overall - while basket price is “remaining strong”

- Sales at Club stores (e.g. Costco, BJ’s) “are growing throughout COVID” with “penetration, trips and baskets” all growing

- In the Household Cleaning category, total combined sales are still up 13% over one year ago, with in-store sales up 12% and online sales up a whopping 28%. And that’s after the panic buying led to stuffed storage rooms and garages.

The widespread and rapid adoption of e-commerce-related activity is likely to have a lasting impact on consumer behavior. Demographic groups that might otherwise have eschewed online shopping are now participating at high rates, and while the introduction to online shopping may have been jarring for many, once it’s a comfortable habit it’s likely to stick.

TREND 2: Efficacy over everything

Home Care “plays a crucial role in limiting the spread of the virus as well as psychological support to households around the world as they battle this invisible threat,” says a report from Euromonitor International. And in response, consumers are reaching for stronger cleaners (and the same is seen in the commercial space, where efficient cleanliness is integral to ensuring consumer trust).

In short, says the Euromonitor International report, “COVID-19 is the antithesis of chemophobia.”In addition to pursuing a wider range of products and significantly higher penetration of antibacterial and bleach products, Euromonitor International reports that users have a “higher propensity for overdosing,” which is “driving volume and value” in home cleaning categories.Nielsen BASES confirms Euromonitor International’s findings, reporting that “consumers now believe that [Home Care] product claims focused on killing germs, providing immunity and overall health promotion are more relevant than claims around naturalness, sustainability, quality and brand.”It’s expected that this dramatic reversal away from green and natural claims may be mitigated somewhat as the virus comes under control – and it’s worth noting that the overall global shift toward sustainability and environmental awareness will play a factor in this shift long-term. However, with far-ranging predictions for the future of this pandemic, let alone future viral threats – plus the psychological impact that the pandemic has had on consumers’ desire to manage their environments – it seems likely that efficacy will continue to be a high priority in the long run. Describing the pandemic as a “threat experience,” Euromonitor International surmises that “households are unlikely to return to pre COVID-19 consumption patterns.” Instead, we may see an increasing shift toward what’s being called “science-based green,” or brands that pursue sustainability measures and environmental considerations without sacrificing efficacy.

In the I&I space, an elevated and proven standard of cleaning will become a cost of entry for businesses to successfully reopen or stay open. I&I areas requiring cleaning and sanitation include kitchen and dining rooms, public areas, food and beverage processing, showers and toilets and medical facilities – and efficacy will be paramount for keeping them clean and safe.There is already a shift toward co-branding partnerships that showcase this phenomenon. As cleanliness becomes a seal of high quality and safety, that seal is increasingly coming in the form of a highly recognizable brand. Examples of these partnerships include Hilton’s collaboration with Lysol® and the Mayo Clinic (Hilton’s “CleanStay with Lysol Protection”). United Airlines has also launched “United CleanPlus” with Clorox. Opportunities will continue to appear as companies look to secure confidence. Case in point:

- Airbnb has announced a new cleaning protocol for hosts, including guidance from a former U.S. Surgeon General

- American Airlines has announced enhanced cleaning procedures and new personal protective equipment for customers

- Marriott has announced a global cleanliness council

And the list will continue to grow.“Consumers are looking for protection and simplification during this pandemic: protection from contact with potential pathogens and simplification of essential activities such as shopping,” said Daniele Piergentili, Vice President, Personal and Home Care, BASF Care Chemicals in North America. After COVID is gone, consumer will continue to prefer products with scientifically proven claims, and trust brands that over the last decades have consistently proven to deliver the safe outcomes promised. In addition, the convenience and safety provided by online purchasing during the pandemic will boost e-commerce as a preferred shopping channel even after the virus is gone.”